- #Money plus sunset deluxe vs quicken deluxe for android

- #Money plus sunset deluxe vs quicken deluxe android

- #Money plus sunset deluxe vs quicken deluxe software

- #Money plus sunset deluxe vs quicken deluxe Pc

- #Money plus sunset deluxe vs quicken deluxe free

#Money plus sunset deluxe vs quicken deluxe android

#Money plus sunset deluxe vs quicken deluxe software

Windows users also have the option of Quicken Home & Business, which keeps track of your personal and small business transactions in one place. You can choose from two annual service plans, Starter and Deluxe, priced at $39.99/year and $62.99/year, respectively.

#Money plus sunset deluxe vs quicken deluxe for android

The application works on both Windows and Mac desktops and features a mobile app available for Android and iOS devices. Quicken is yet another top name in the world of budgeting software. Build an emergency fund with the Age Your Money concept.Allows you to adjust your budget in real-time to avoid overspending.Best suited for hands-on money management.YNAB is a paid personal finance app, and it’ll set you back $11.99/month, although you get a bit of a discount if you choose annual billing ($84/year).

YNAB follows the following four principles: Give Every Dollar a Job, Embrace Your True Expenses, Roll with the Punches, and Age Your Money. YNAB encourages users to be proactive with their money and to know where every dollar is going. Like Mint, You Need A Budget is another popular budgeting software, but it’s more hands-on.

#Money plus sunset deluxe vs quicken deluxe free

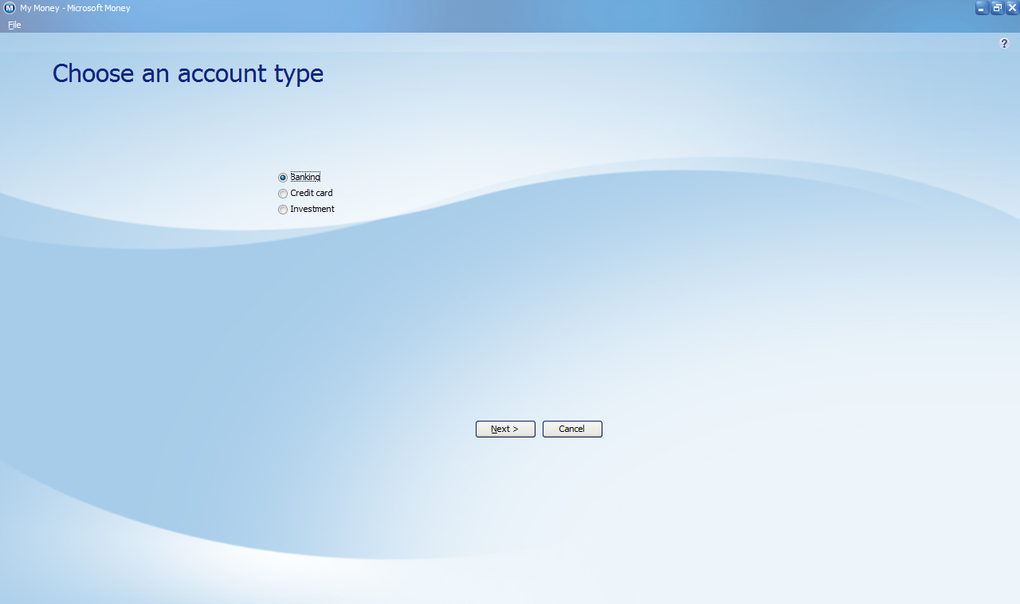

Mint is free to use, and it’s packed with features designed to make managing your money easy. Mint is one of the most popular personal apps available today, with millions of users in Canada and the U.S. Let’s take a closer look at some of the top budgeting apps available today. Whether you’re a former Microsoft Money desktop software user or you’re still hanging on with Sunset Deluxe, it’s time to step into 2020. There is no available support and no access to automatic statement updates, online bill payments, or online investment quotes. While Sunset may hold some appeal to previous Money users looking to manage their budget, it can’t compete with the feature-laden, mobile-friendly personal finance apps of today. Microsoft Money Plus Sunset DeluxeĪfter the demise of Money in 2009, Microsoft released Money Plus Sunset Deluxe, a downloadable application that made it possible to upload and edit Microsoft Money files.

#Money plus sunset deluxe vs quicken deluxe Pc

It enabled users to take charge of their personal finances from their PC desktop, including the ability to make budgets, track expenses, and view their bank account transactions in one place. For almost 20 years, Microsoft Money was considered one of the leading personal finance software applications on the market.

0 kommentar(er)

0 kommentar(er)